The boom of silicon wafers in the photovoltaic industry

Against the background of the carbon neutrality goal and the accelerated application of global clean energy, China’s photovoltaic industry as a whole has achieved rapid growth.

According to corporate information and industry standard announcements from industry associations, the main links in the national photovoltaic industry chain have maintained strong development momentum, with a year-on-year growth rate of more than 45%.

Among them, polysilicon increased by 53.4% year-on-year, silicon wafers increased by 45.5% year-on-year. Cells increased by 46.6% year-on-year, and modules increased by 54.1% year-on-year. Overseas photovoltaic market demand continues to be strong, and sales and prices have increased.

In the first half of the year, module export volume reached 78.6GW, a year-on-year increase of 74.3%, and the total export volume of photovoltaic products was approximately US$2.59 billion, a year-on-year increase of 113.1%.

The iteration of photovoltaic technology is accelerating, and the iteration of technical routes has promoted the upgrading of new generations of equipment and increased the value of equipment.

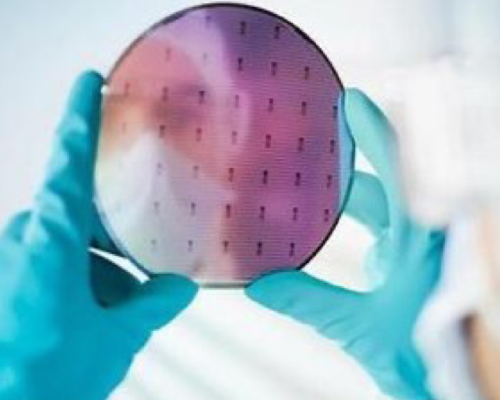

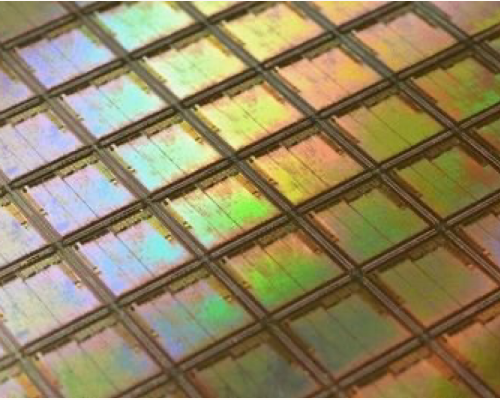

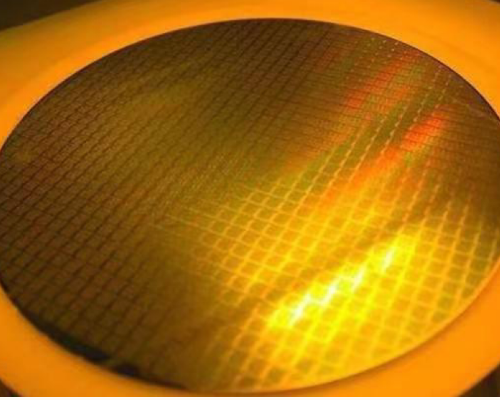

Silicon wafers are developing in the direction of large size, and silicon wafers are developing in the direction of thinning. Large silicon wafer equipment will gradually undergo a large number of upgrades.

Cells will gradually develop in the direction of university cells, and TOPCon and HJT will gradually become mainstream in the future. In particular, HJT will bring about the upgrading of the entire production line equipment, leaving a large space for equipment investment.

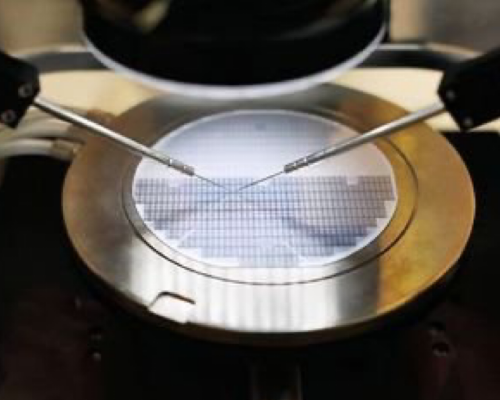

Crystalline silicon material is the most important photovoltaic material, with a market share of more than: 90%. Solar-grade polysilicon used in photovoltaic production requires polysilicon purity exceeding 100°C 99.9999%.

According to the 2021 China Photovoltaic Industry External Development Annual Report, national polysilicon production will reach 505,000 tons in 2021, a year-on-year increase of 28.8%; imported polysilicon is 204 million US dollars, a sharp increase of 114% year-on-year, and the import volume is 114,000 tons, a year-on-year increase of 13.4%.

It is expected that there will still be a large capacity gap in upstream industrial silicon and polysilicon in the next five years. In addition, the number of new photovoltaic installations worldwide is also growing steadily, driving a series of changes in the silicon industry chain.

Photovoltaic silicon wafers are accelerating to “large size” and “piece”. As the area of silicon wafers increases, the number of chips produced each time increases, and the probability of chip defects will also decrease, so the output of the chips will be significantly improved, thereby greatly Reduced costs.

Downstream silicon wafer companies continue to drive demand for advanced production capacity expansion in large-scale competition, and old semiconductor factories are gradually being replaced.

How to produce qualified and larger-sized silicon wafers has always been the focus of silicon wafer companies. Silicon wafer companies are also undergoing a new round of upgrading.

In addition to the continuous expansion of new production capacity by silicon wafer manufacturers, the replacement of inventory production capacity will also bring about some equipment demand.